2025 Sinking Fund Millage Proposal

In the upcoming special election on May 6, 2025, voters will be asked to vote on a Sinking Fund millage.

What is a Sinking Fund?

A Sinking Fund allows a school district to make improvements for specific purposes, as allowed by the state.

If approved, it would allow Reese Public Schools to create a fund to be used for purposes including building repairs, safety, instructional technology, and transportation.

How is it funded?

A Sinking Fund is created by a local tax millage and is levied on all property located in a school district. The district proposal is a ZERO INCREASE from the 2024 levy at 1.5 mills, which would generate $445,370 annually for 5 years for district improvements.

Is this a renewal?

While the district has had a Sinking Fund for more than 25 years, and this is a ZERO INCREASE from the 2024 levy, we legally cannot call this a renewal because of the state now allowing transportation costs to be added to the language. With the added transportation language, we are technically asking for a different proposal.

How will my taxes be affected?

There would be no change from the 2024 levy. The district is asking for the same amount (1.5 mills). Please note, taxable value is generally half (or less) of the market value of your property.

| Taxable Value | Est. Monthly Cost |

|---|---|

| $50,000 | $6.25 |

| $100,000 | $12.50 |

| $150,000 | $18.75 |

What we CAN spend a Sinking Fund on...

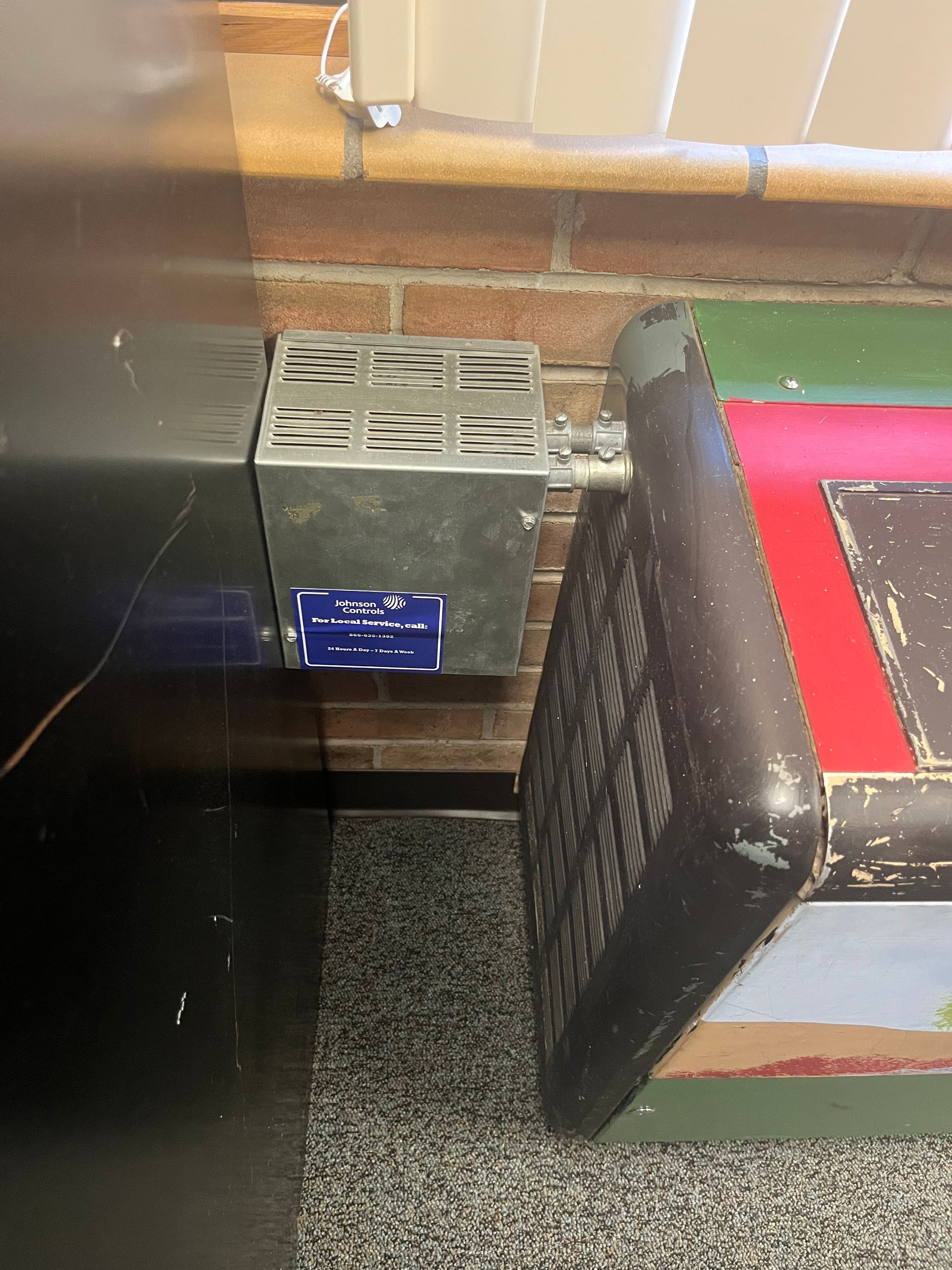

- Heating and Cooling Systems

- Roofs

- Parking Lot, Sidewalks, and Asphalt

- Safety and Security

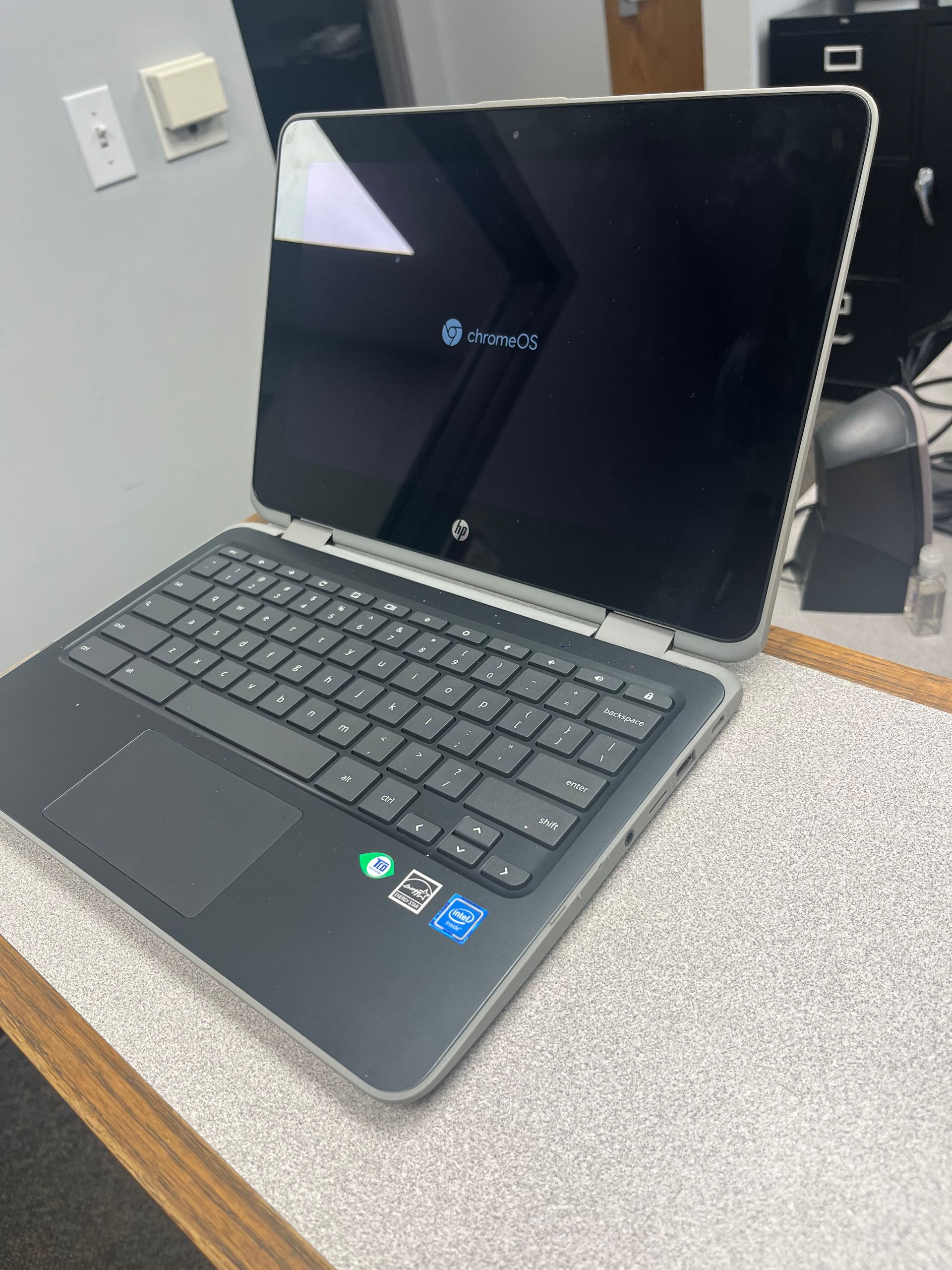

- Instructional Technology

- Transportation

- Real Estate

What we CANNOT spend Sinking Fund on...

- Salaries and Benefits

- Equipment and Supplies

- Textbooks

- Utilities and Operational Expenses

- Furniture

- General Maintenance

Past Sinking Fund Projects

2024-2025

- Elementary Parking Lot

- Middle/High School roof repair

- Middle/High School tree removal and planting

- Concrete work at Elementary

- Storage at Elementary

- New exterior doors at Middle/High School

2023-2024

- Middle/High School roof repair

- Elementary Boiler repair

- Middle/High School Emergency lights

- Elementary Emergency lights

- Elementary School Gym Roof

2022-2023

- Rebuild of Middle/High School pillars

2021-2022

- New windows at Middle/High School

- Middle/High School Parking Lot

- Elementary Parking Lot

Other Projects

- Rennovation of Middle/High School to add Middle School wing

- New Bathrooms at Middle/High School

- Gymnasium Bleachers at Middle/High School

- Auditorium

- Windows and Doors at Elementary School

- Renovations of Parking Lots

- Addition of Circle Drive

- New lights at Football Field

- Middle School Labs

- Sprinkler System at Football and Baseball fields

- Baseball/Football Concession Stand

- Concession Stand at Track

- Auditorium Storage

- Sprinkler System at practice football field

- Sidewalks at Elementary School Court Yard

- Security System at all buildings

Slide title

Completed Sinking Fund Repairs

ButtonSlide title

Completed Sinking Fund Repairs

ButtonSlide title

Completed Sinking Fund Repairs

ButtonSlide title

Completed Sinking Fund Repairs

ButtonSlide title

Completed Sinking Fund Repairs

Button

Why does our school district need a Sinking Fund?

The Sinking Fund allows us to repair and improve school facilities, ensuring a safe and conducive learning environment without diverting funds from instructional programs, and keeping more money in the classroom.

How much would the Sinking Fund cost me?

The cost depends on the property value and is equal to $1.50 per $1,000 of taxable value.

How long would the Sinking Fund be in place?

The Sinking Fund levy would be for 5 years, after which it could be renewed by voters.

Can funds from the Sinking Fund be used for anything else?

No, by law, Sinking Fund revenue can only be used for repairs, and improvements to school buildings and grounds, instructional technology , real estate, and transportation purchase and maintenance.

What happens if the Sinking Fund if not approved?

Without the Sinking Fund, necessary repairs and improvement may be delayed or not completed, potentially leading to more costly issues in the future. This could also impact the overall learning environment and safety. There would also be short and long term financial strain on the district.

What is the difference between a Sinking Fund and a Bond?

A sinking fund is used on a “pay as you go basis” and all monies collected are utilized to directly benefit the district. A bond is a form of borrowing, which means taxpayers must pay back the borrowed funds over a period of years with interest. A sinking fund is levied, not borrowed, which means the revenues are generated from a tax and do not include the district taking on additional debt or interest expense.